Facebook Messenger could integrate Apple Pay, opening up a world of possibilities for seamless mobile payments within the platform. Imagine effortlessly sending money to friends, making purchases from businesses, and even tipping your favorite creators, all with the security and convenience of Apple Pay. This integration could transform Facebook Messenger into a comprehensive financial hub, fostering a vibrant ecosystem of social commerce and mobile payments.

The potential benefits are numerous. Users would enjoy a streamlined payment experience, eliminating the need to enter card details repeatedly. Apple Pay’s robust security features would also enhance transaction safety, mitigating concerns about data breaches and fraud. This integration could further boost mobile commerce, encouraging users to explore a wider range of products and services within the Messenger app.

The Potential Benefits of Integrating Apple Pay

Integrating Apple Pay into Facebook Messenger could revolutionize the way users interact with the platform, offering a seamless and secure payment experience. This integration would unlock a world of possibilities, making it easier for users to make purchases, send money, and manage their finances directly within the familiar environment of Messenger.

Enhanced User Experience and Convenience

Apple Pay’s integration would enhance the user experience by simplifying the payment process. Users could effortlessly make purchases without needing to enter their card details repeatedly, streamlining the checkout process and reducing friction. This convenience would encourage users to make more frequent purchases, leading to increased engagement and satisfaction.

Impact on Purchasing Power and Online Transactions

By integrating Apple Pay, Facebook Messenger could empower users to make purchases more readily. The seamless and secure payment experience would encourage users to make impulse purchases, leading to increased spending. Furthermore, the integration would enable users to access a wider range of goods and services available online, expanding their purchasing power and driving growth in online transactions.

Increased Mobile Commerce and Social Shopping Opportunities

The integration of Apple Pay could fuel the growth of mobile commerce and social shopping. With the ability to make secure and convenient purchases directly within the Messenger app, users would be more inclined to explore and buy products from businesses and friends. This could lead to a surge in mobile commerce and social shopping opportunities, transforming the way users interact with businesses and brands.

Security and Privacy Considerations

Integrating Apple Pay into Facebook Messenger raises significant security and privacy concerns. The potential for data breaches, unauthorized access, and misuse of personal information needs careful consideration.

Security Implications

The integration of Apple Pay into Facebook Messenger introduces several security implications. One key concern is the potential for data breaches, where sensitive information like payment details and user data could be compromised.

- Data breaches: A security breach could expose users’ payment information, including credit card numbers, expiration dates, and security codes, to unauthorized individuals. This could lead to fraudulent transactions and identity theft.

- Unauthorized access: If Facebook Messenger’s security measures are inadequate, malicious actors could gain access to user accounts and potentially steal their payment information. This could happen through phishing attacks, malware, or other hacking techniques.

- Malware and phishing attacks: Malicious software or phishing scams targeting Facebook Messenger could trick users into providing their payment details or compromising their accounts. This could allow attackers to steal their payment information or make unauthorized purchases.

Vulnerability Mitigation

To mitigate these vulnerabilities, Facebook and Apple must implement robust security measures.

- Strong authentication: Two-factor authentication (2FA) should be mandatory for all users who link their Apple Pay accounts to Facebook Messenger. This adds an extra layer of security by requiring users to enter a code sent to their phone in addition to their password.

- Encryption: All user data, including payment information, should be encrypted both in transit and at rest. This makes it much harder for attackers to intercept or access sensitive data even if they gain unauthorized access to Facebook Messenger’s systems.

- Regular security audits: Facebook and Apple should conduct regular security audits to identify and address potential vulnerabilities in their systems. These audits should be conducted by independent security experts to ensure objectivity and thoroughness.

- Security awareness training: Facebook should educate users about common security threats, such as phishing scams and malware, and provide guidance on how to protect their accounts and payment information. This could involve providing tips on identifying suspicious messages, avoiding suspicious links, and using strong passwords.

Privacy Concerns

Integrating Apple Pay into Facebook Messenger raises concerns about the potential for data misuse and privacy violations.

- Data collection and usage: Facebook has a history of collecting and using user data for targeted advertising. Integrating Apple Pay could provide Facebook with more data about users’ spending habits and preferences, which could be used to create more detailed user profiles for advertising purposes.

- Data sharing with third parties: Facebook could potentially share user data, including payment information, with third-party advertisers or other partners. This could raise concerns about the security and privacy of users’ sensitive information.

- Lack of transparency: Facebook should be transparent about how it collects, uses, and shares user data, including payment information. This transparency is crucial for building trust and ensuring users feel comfortable linking their Apple Pay accounts to the platform.

Data Security and Privacy Protection

To address these concerns, Facebook and Apple must prioritize user data security and privacy.

- Data minimization: Facebook should only collect and store data that is absolutely necessary for the functioning of the platform and the Apple Pay integration. Any unnecessary data collection should be avoided.

- User consent: Users should be given clear and concise information about how their data will be used before they link their Apple Pay accounts to Facebook Messenger. They should have the option to opt out of data sharing or use their payment information for advertising purposes.

- Data deletion: Users should have the right to delete their payment information and other sensitive data from Facebook Messenger at any time. Facebook should make this process easy and accessible for users.

- Privacy-focused design: Facebook should design its systems and features with privacy in mind. This means implementing data protection measures by default, minimizing data collection, and providing users with control over their data.

The Competitive Landscape and Market Impact

Integrating Apple Pay into Facebook Messenger places it in the midst of a growing trend among social media platforms to offer integrated payment solutions. This move positions Facebook Messenger within a competitive landscape where several players are vying for user adoption and market share.

Comparison with Other Platforms

The integration of Apple Pay into Facebook Messenger presents a direct challenge to other social media platforms that have already implemented similar payment options. Here’s a comparison:

- WeChat (China): WeChat is a leading example of a social media platform that has seamlessly integrated payments into its ecosystem. Its WeChat Pay system allows users to send money, pay bills, and purchase goods and services within the app. This integrated approach has contributed significantly to WeChat’s dominance in the Chinese mobile payments market.

- Alipay (China): Similar to WeChat Pay, Alipay is another prominent player in the Chinese mobile payments landscape. It offers a comprehensive suite of financial services, including peer-to-peer payments, online shopping, and utility bill payments. Alipay’s integration into social media platforms has propelled its growth and widespread adoption in China.

- WhatsApp (Global): WhatsApp, owned by Meta (Facebook’s parent company), has also introduced payment features in select markets. Its WhatsApp Pay service enables users to send and receive money within the app, directly competing with traditional financial institutions in some regions.

- Venmo (United States): Venmo, a popular mobile payment app owned by PayPal, has gained significant traction in the United States. It allows users to send and receive money between friends and family, making it a convenient alternative to traditional payment methods.

Market Impact and Competition

The integration of Apple Pay into Facebook Messenger has the potential to significantly impact the market and intensify competition among social media platforms. This move could lead to:

- Increased User Adoption: By offering a convenient and secure payment option, Facebook Messenger could attract a wider user base, particularly those who are already familiar with Apple Pay. This could potentially increase the platform’s overall user engagement and revenue.

- Shift in Consumer Behavior: The integration of Apple Pay could encourage consumers to adopt social media platforms for more transactions, potentially reducing reliance on traditional payment methods and financial institutions. This shift could reshape the mobile payments landscape and create new opportunities for social media companies.

- Competitive Pressure: The integration of Apple Pay could incentivize other social media platforms to enhance their payment offerings. This could lead to a race to provide the most convenient, secure, and feature-rich payment solutions, ultimately benefiting users with more options and innovation.

Advantages and Disadvantages for Facebook Messenger

Facebook Messenger’s integration of Apple Pay presents both potential advantages and disadvantages:

Advantages

- Enhanced User Convenience: Integrating Apple Pay streamlines the payment process for users, eliminating the need for manual card entry or account setup. This convenience could encourage users to make more transactions within the app.

- Increased Security and Privacy: Apple Pay utilizes tokenization and biometric authentication, enhancing security and privacy compared to traditional payment methods. This could attract users who prioritize security and data protection.

- Expanded Reach and Market Share: By offering Apple Pay, Facebook Messenger can reach a wider user base, including those who prefer Apple devices and are already familiar with Apple Pay. This could lead to increased user adoption and market share.

Disadvantages

- Dependence on Apple: Facebook Messenger’s integration with Apple Pay creates a dependency on Apple’s infrastructure and policies. This could limit flexibility and potentially lead to compatibility issues in the future.

- Limited Reach: Apple Pay is primarily available in developed markets, limiting the reach of Facebook Messenger’s payment feature in emerging markets where other payment options may be more prevalent.

- Competition with Other Payment Options: Facebook Messenger will face competition from other payment solutions, including Google Pay, PayPal, and traditional financial institutions. This competition could make it challenging to attract and retain users.

Strategies for Effective Competition

To effectively compete in the evolving mobile payments landscape, Facebook Messenger can implement the following strategies:

- Expand Payment Options: Offer a wider range of payment methods, including Google Pay, PayPal, and other popular options, to cater to a broader user base.

- Develop Innovative Features: Introduce new features and functionalities that enhance the payment experience, such as personalized recommendations, loyalty programs, and gamification elements.

- Strengthen Security and Privacy: Invest in robust security measures and data privacy practices to build user trust and confidence in the platform’s payment capabilities.

- Promote Partnerships: Collaborate with merchants, retailers, and financial institutions to expand the platform’s reach and provide users with more payment options and incentives.

- Target Emerging Markets: Explore opportunities to expand into emerging markets with a focus on local payment preferences and regulations.

User Adoption and User Interface Design

The success of integrating Apple Pay into Facebook Messenger hinges on a user-friendly interface that seamlessly integrates with the existing platform. This section delves into the design considerations, setup process, and visual representation of the integration, focusing on optimizing user adoption and ensuring a smooth payment experience.

User Interface Design

A well-designed user interface is crucial for promoting user adoption and facilitating a seamless payment experience. The integration should be intuitive and familiar to users, leveraging existing Facebook Messenger features and design elements to minimize the learning curve.

- Integration with Existing Features: Apple Pay should be seamlessly integrated with existing Messenger features like group chats, payments, and business profiles. Users should be able to initiate payments without navigating away from their current conversation or profile.

- Clear and Concise Call to Action: The call to action for initiating an Apple Pay payment should be prominent and clearly labeled. This could be a dedicated button or icon within the chat window or profile.

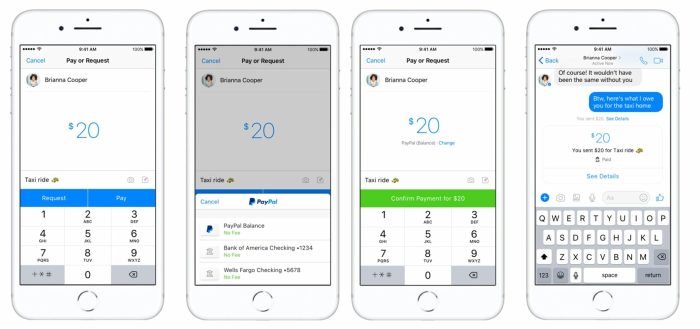

- Visual Cues and Confirmation: The integration should provide clear visual cues throughout the payment process, confirming the selected payment method, amount, and recipient. This helps prevent errors and builds user confidence.

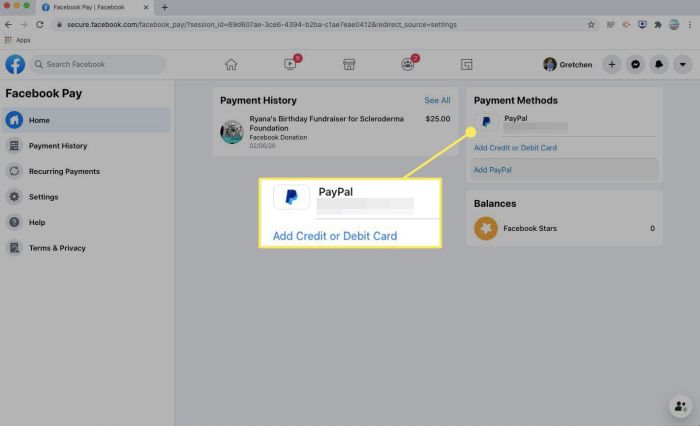

Setup and Usage

Setting up and using Apple Pay within Messenger should be a straightforward process, minimizing user friction and maximizing adoption. The setup process should be familiar to users who have already set up Apple Pay on other devices.

- Linking Apple Pay Account: Users can link their Apple Pay account to Messenger by selecting the Apple Pay option within the payment settings. This step should be guided by clear instructions and visual cues.

- Choosing a Payment Method: After linking their account, users can select their preferred payment method from their linked Apple Pay cards. This selection should be visually presented and easy to navigate.

- Initiating Payments: Once the payment method is selected, users can initiate payments within the Messenger chat window or business profile. The payment process should be simple and visually intuitive, with clear confirmation messages.

Visual Representation

A visual representation of the user interface can help illustrate the integration process and payment options. The following mockups or wireframes demonstrate a potential user interface design for Apple Pay within Facebook Messenger.

[Image Description]: The mockup showcases a Facebook Messenger chat window. At the bottom of the window, there is a new “Pay” button next to the existing “Send” button. When clicked, a pop-up appears, displaying a list of payment options, including Apple Pay, credit cards, and other payment methods. Users can select Apple Pay and then confirm the payment amount and recipient. The interface includes clear visual cues and confirmation messages throughout the payment process.

User Interface Optimization, Facebook messenger could integrate apple pay

Optimizing the user interface can significantly impact user adoption and payment experience. The following strategies can be implemented to ensure a seamless and intuitive experience:

- A/B Testing: Conduct A/B testing to evaluate different interface designs and user flows, identifying the most effective and user-friendly options.

- User Feedback: Gather feedback from users throughout the development process, incorporating their suggestions and insights to improve the user interface.

- Accessibility: Ensure the interface is accessible to users with disabilities, adhering to accessibility guidelines and standards.

- Mobile-First Design: Prioritize mobile-first design principles, ensuring the interface is optimized for various screen sizes and touch interactions.

The Future of Social Commerce and Mobile Payments: Facebook Messenger Could Integrate Apple Pay

The integration of Apple Pay into Facebook Messenger has the potential to significantly reshape the landscape of social commerce and mobile payments. This integration could foster a more seamless and convenient shopping experience, blurring the lines between social interaction and online transactions.

Facebook Messenger as a Platform for Online Transactions and Shopping

The integration of Apple Pay into Facebook Messenger could transform the platform into a comprehensive hub for online transactions and shopping. Imagine a future where users can seamlessly browse products, make purchases, and receive deliveries directly within the messaging app. This would eliminate the need to switch between multiple apps or websites, streamlining the entire shopping journey.

- In-App Shopping: Facebook Messenger could become a central marketplace where users can browse products from various retailers, compare prices, and make purchases directly within the app.

- Personalized Recommendations: By leveraging user data and purchase history, Facebook Messenger can offer personalized product recommendations and tailored shopping experiences, increasing the likelihood of successful transactions.

- Social Commerce Integration: Integrating social commerce features into Facebook Messenger could allow users to share products with friends, seek recommendations, and engage in group purchases, fostering a collaborative shopping experience.

- Instant Payments: Apple Pay’s secure and convenient payment processing capabilities can simplify the checkout process, enabling users to make purchases with just a few taps.

Impact on Social Media Marketing and Advertising

The integration of Apple Pay into Facebook Messenger could fundamentally alter the way businesses approach social media marketing and advertising. By providing a seamless checkout experience, businesses can drive higher conversion rates and increase customer engagement.

- Targeted Advertising: Businesses can leverage user data and purchase history to deliver targeted advertising campaigns within Facebook Messenger, ensuring that promotions reach the right audience.

- Interactive Shopping Experiences: Facebook Messenger can be used to create interactive shopping experiences, such as product demos, virtual try-ons, and live shopping events, enhancing customer engagement and driving sales.

- Personalized Promotions: Businesses can offer personalized promotions and discounts based on user preferences and purchase history, encouraging repeat purchases and building customer loyalty.

Emerging Trends in Mobile Payments

The mobile payments landscape is constantly evolving, with emerging trends influencing the integration of Apple Pay into Facebook Messenger.

- Contactless Payments: The rise of contactless payments, driven by the COVID-19 pandemic, has accelerated the adoption of mobile payment solutions like Apple Pay, making them a preferred choice for consumers.

- Biometric Authentication: Mobile payment platforms are increasingly incorporating biometric authentication features, such as facial recognition and fingerprint scanning, to enhance security and convenience.

- Blockchain Technology: Blockchain technology has the potential to revolutionize mobile payments by providing secure and transparent transaction records, reducing fraud and increasing trust.

- Mobile Wallets: Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, are becoming increasingly popular, offering users a convenient and secure way to store and manage their payment information.

The integration of Apple Pay into Facebook Messenger presents a compelling opportunity to revolutionize social commerce and mobile payments. While security and privacy concerns require careful consideration, the potential benefits for users, businesses, and the platform itself are undeniable. As mobile payments continue to evolve, Facebook Messenger could play a pivotal role in shaping the future of online transactions, making it easier and more secure for people to connect, communicate, and conduct business.

While Facebook Messenger integrating Apple Pay could be a convenient feature for many, it’s important to remember that even the most anticipated updates can have their downsides. Take for example the Android 6.0 Marshmallow update for the Sony Xperia Z5, which, as reported in this article , has caused frustration among users due to performance issues and battery life concerns.

Ultimately, the success of any new feature hinges on a smooth user experience, and that requires thorough testing and careful implementation.