Authorize net supported processors – Authorize.Net Supported Processors: A gateway to seamless online transactions, Authorize.Net offers a robust selection of payment processors catering to diverse business needs. This platform empowers businesses to accept payments from a wide range of customers, streamlining the checkout process and enhancing the overall customer experience.

This comprehensive guide delves into the world of Authorize.Net supported processors, exploring their features, benefits, integration capabilities, and security protocols. We’ll examine how these processors facilitate secure and efficient transactions, ultimately contributing to a thriving online business.

Authorize.Net Overview

Authorize.Net is a leading payment gateway provider that simplifies online payment processing for businesses of all sizes. It acts as a secure intermediary between merchants and payment processors, facilitating seamless transactions and providing essential tools for managing payments.

Key Features and Benefits

Authorize.Net offers a comprehensive suite of features designed to enhance online payment processing efficiency and security. These features include:

- Secure Payment Processing: Authorize.Net employs industry-standard encryption and security protocols to safeguard sensitive customer data, ensuring secure transactions.

- Multiple Payment Options: Merchants can accept a wide range of payment methods, including credit cards, debit cards, ACH transfers, and digital wallets, expanding their customer base.

- Recurring Billing: Automate recurring payments for subscriptions, memberships, or other recurring services, simplifying payment management for both businesses and customers.

- Fraud Prevention Tools: Authorize.Net offers built-in fraud detection and prevention tools to minimize the risk of fraudulent transactions, protecting businesses from financial losses.

- Detailed Reporting and Analytics: Gain insights into transaction history, customer behavior, and payment trends through comprehensive reporting and analytics tools, enabling data-driven decision-making.

- Customer Support: Authorize.Net provides reliable customer support, offering assistance with account setup, transaction processing, and troubleshooting issues.

History of Authorize.Net

Authorize.Net was founded in 1996 as a division of CyberSource Corporation, a leading provider of payment processing solutions. The company quickly gained popularity for its user-friendly interface and robust security features. In 2007, Authorize.Net was acquired by Visa, solidifying its position as a trusted and reputable payment gateway provider. Over the years, Authorize.Net has continuously evolved, incorporating new technologies and features to meet the evolving needs of businesses.

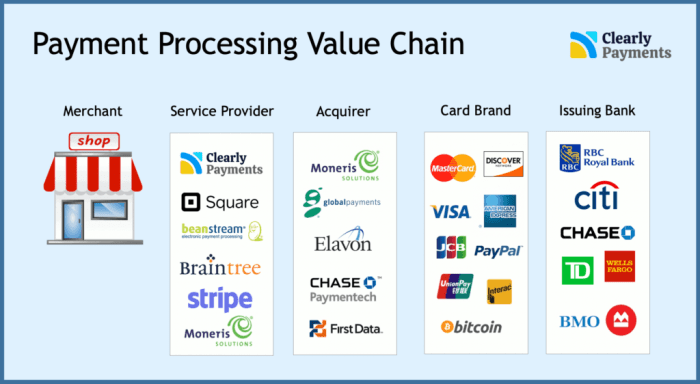

Supported Payment Processors

Authorize.Net supports a wide range of payment processors, providing businesses with flexibility and options to choose the best fit for their specific needs. These processors handle the complex transactions between merchants and customers, enabling seamless and secure payments.

Payment Processor Comparison

Understanding the different payment processors and their features is crucial for choosing the right one. This section compares and contrasts various processors based on their key characteristics, including fees, target audience, and features.

Key Features

- Transaction Fees: This refers to the percentage of each transaction charged by the processor. These fees can vary based on the processor and the type of transaction.

- Monthly Fees: Some processors may charge a monthly fee for using their services, while others offer a flat fee structure.

- Payment Methods: Different processors support different payment methods, including credit cards, debit cards, ACH transfers, and digital wallets.

- Security Features: Robust security features are essential for protecting sensitive customer data. These features can include fraud detection, encryption, and tokenization.

- Customer Support: Reliable customer support is crucial for resolving issues and receiving assistance. The level of support provided can vary depending on the processor.

Target Audience

- Small Businesses: Processors specifically designed for small businesses often offer affordable pricing and simplified features.

- Large Enterprises: Processors for large enterprises typically offer advanced features, higher transaction limits, and dedicated support.

- Specific Industries: Some processors cater to specific industries, such as e-commerce, healthcare, or hospitality, providing tailored solutions.

Integration Process

Integrating a payment processor with your business requires specific steps and considerations. The integration process can vary depending on the processor and your chosen platform.

Steps Involved

- Account Setup: Create an account with the chosen processor and provide the required information.

- API Integration: Integrate the processor’s API into your website or platform to enable secure transactions.

- Testing and Validation: Thoroughly test the integration to ensure it functions correctly and meets security standards.

- Go Live: Once testing is complete, activate the integration and start accepting payments.

Supported Payment Processors

- Stripe: A popular processor known for its user-friendly interface and comprehensive features. It caters to businesses of all sizes and offers a wide range of payment methods.

- PayPal: A well-established processor with a large user base. It’s known for its convenience and global reach, offering both online and in-person payment options.

- Square: A processor primarily designed for small businesses, offering point-of-sale solutions and mobile payments. It’s known for its ease of use and affordability.

- Braintree: A processor owned by PayPal, known for its robust features and enterprise-grade security. It’s suitable for businesses with high transaction volumes.

- Authorize.Net: A processor offering a comprehensive suite of payment gateway services. It’s known for its reliability and security, providing features for both small and large businesses.

Integration with eCommerce Platforms: Authorize Net Supported Processors

Authorize.Net seamlessly integrates with a wide range of popular eCommerce platforms, allowing businesses to streamline their payment processing and enhance the customer checkout experience. This integration provides a unified solution for accepting payments, managing transactions, and improving overall business efficiency.

Popular eCommerce Platforms

Authorize.Net offers native integrations with several popular eCommerce platforms, simplifying the setup and management of online payments. These platforms include:

- Shopify

- BigCommerce

- Magento

- WooCommerce

- 3dcart

- PrestaShop

- OpenCart

Integration Steps

The integration process with Authorize.Net typically involves the following steps:

- Create an Authorize.Net Account: Sign up for an Authorize.Net account and choose a suitable payment gateway plan based on your business needs.

- Install the Authorize.Net Plugin or Extension: Most eCommerce platforms have dedicated Authorize.Net plugins or extensions available in their app stores. Install the relevant plugin for your platform.

- Configure Payment Settings: Within the plugin settings, provide your Authorize.Net API credentials, including your API Login ID, Transaction Key, and other relevant details. This establishes the connection between your platform and Authorize.Net.

- Test the Integration: Before going live, thoroughly test the integration by placing test orders to ensure that transactions are processed correctly and funds are deposited into your account.

Checkout Experience Enhancement

Authorize.Net enhances the checkout experience on various eCommerce platforms by offering features that simplify the payment process for customers:

- Secure Payment Processing: Authorize.Net provides robust security measures, including encryption and fraud prevention tools, ensuring safe and secure transactions for both businesses and customers.

- Multiple Payment Options: Customers can choose from various payment methods, such as credit cards, debit cards, and digital wallets, increasing convenience and flexibility at checkout.

- Recurring Billing: Authorize.Net enables businesses to set up recurring billing for subscription services or recurring payments, simplifying customer management and increasing revenue.

- Mobile Optimization: The platform is optimized for mobile devices, providing a seamless checkout experience for customers using smartphones or tablets.

Payment Security and Compliance

Authorize.Net prioritizes the security of your transactions and customer data. They employ a comprehensive suite of security measures and adhere to industry best practices to ensure a secure payment processing experience.

Security Measures

Authorize.Net implements robust security measures to safeguard sensitive data during every stage of the payment process.

- Data Encryption: All data transmitted between your website and Authorize.Net’s servers is encrypted using industry-standard Secure Sockets Layer (SSL) technology. This ensures that sensitive information, such as credit card numbers, is protected from unauthorized access during transmission.

- Tokenization: Authorize.Net replaces sensitive data with unique tokens, which are random strings of characters. These tokens are then used in subsequent transactions, effectively masking the actual card details. This process significantly reduces the risk of data breaches, as sensitive information is never stored on your servers.

- Firewalls and Intrusion Detection Systems: Authorize.Net’s infrastructure is protected by advanced firewalls and intrusion detection systems, which monitor network traffic and identify potential threats. These security measures help prevent unauthorized access to their systems and protect sensitive data.

- Regular Security Audits: Authorize.Net undergoes regular security audits by independent third-party organizations to ensure their systems and processes meet the highest security standards. These audits help identify potential vulnerabilities and ensure that Authorize.Net’s security practices are effective.

PCI DSS Compliance

Authorize.Net is fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to protect cardholder data. They have achieved Level 1 PCI DSS compliance, the highest level of compliance, which demonstrates their commitment to protecting sensitive payment information.

Best Practices for Secure Payment Processing

Merchants can further enhance their payment security by implementing the following best practices:

- Use Strong Passwords: Merchants should use strong, unique passwords for their Authorize.Net account and other online services. Strong passwords include a combination of uppercase and lowercase letters, numbers, and symbols.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring merchants to enter a unique code sent to their mobile device in addition to their password. This makes it significantly harder for unauthorized individuals to access merchant accounts.

- Keep Software Updated: Regularly update your website’s software and plugins to ensure that you are using the latest security patches. Outdated software can contain vulnerabilities that attackers can exploit.

- Train Employees on Security Best Practices: Ensure that all employees handling sensitive payment information are trained on security best practices. This includes educating them on how to recognize phishing attempts, how to handle customer data securely, and how to report suspicious activity.

- Monitor Account Activity: Regularly monitor your Authorize.Net account activity for any suspicious transactions or unauthorized access. This can help you identify potential security breaches early on.

Transaction Processing and Reporting

Authorize.Net handles transactions seamlessly, providing merchants with a comprehensive platform to manage and analyze their payment data. This section will delve into the transaction processing flow, explore how merchants can track and manage transactions, and discuss the reporting tools available for analyzing transaction data.

Transaction Processing Flow

Authorize.Net facilitates secure and efficient transaction processing. The flow typically involves the following steps:

- Customer Initiates Payment: The customer places an order on the merchant’s website or through a point-of-sale system.

- Merchant Sends Request to Authorize.Net: The merchant’s system sends a request to Authorize.Net with payment details, including the amount, card information, and other relevant data.

- Authorize.Net Authenticates and Authorizes: Authorize.Net validates the customer’s payment information and communicates with the issuing bank to authorize the transaction.

- Response to Merchant: Authorize.Net sends a response to the merchant, indicating whether the transaction was approved or declined. The response includes the authorization code (if approved) and any error messages (if declined).

- Settlement: If the transaction is approved, the merchant’s bank will settle the funds to the merchant’s account based on the agreed-upon schedule.

Transaction Tracking and Management

Authorize.Net offers a user-friendly interface for merchants to track and manage their transactions. Key features include:

- Transaction History: Merchants can access a detailed transaction history, including transaction date, amount, payment method, and status.

- Search and Filter: The platform allows merchants to search and filter transactions based on various criteria, such as date range, transaction ID, or payment type.

- Transaction Details: Merchants can view detailed information about individual transactions, including the customer’s billing address, shipping address, and order details.

- Transaction Management: Merchants can perform various actions on transactions, such as voiding, refunding, or capturing funds.

Reporting Tools

Authorize.Net provides a suite of reporting tools to help merchants analyze their transaction data and gain valuable insights into their business performance.

- Transaction Summary Reports: These reports provide an overview of transaction volume, revenue, and other key metrics over different time periods.

- Detailed Transaction Reports: These reports provide a more granular view of individual transactions, including customer information, payment details, and transaction status.

- Payment Method Reports: These reports provide insights into the distribution of payments by different methods, such as credit cards, debit cards, or ACH transfers.

- Customer Reports: These reports provide information about customer demographics, purchase history, and other relevant data.

- Custom Reports: Merchants can create custom reports to analyze specific aspects of their business based on their unique needs.

Merchant Account Requirements

To process payments through Authorize.Net, you need to have a merchant account. This account serves as a bridge between your business and the payment processing network. To obtain an Authorize.Net merchant account, you must meet certain eligibility criteria and provide necessary documentation.

Eligibility Criteria

Authorize.Net Artikels specific requirements for businesses seeking to open a merchant account. These criteria aim to ensure that only legitimate and trustworthy businesses are granted access to payment processing services.

- Business Type: Authorize.Net accepts a wide range of business types, including sole proprietorships, partnerships, corporations, and LLCs. However, certain industries, such as those involving adult content, gambling, or high-risk transactions, may not be eligible.

- Business Location: Authorize.Net primarily serves businesses operating in the United States and Canada. However, businesses operating in other countries may be eligible under certain circumstances.

- Credit History: A good credit history is generally required. This ensures that businesses have a track record of responsible financial management, which is important for processing payments securely and reliably.

- Bank Account: A valid bank account is necessary for receiving payments and settling transactions. The bank account should be in the name of the business applying for the merchant account.

Documentation Requirements

To apply for an Authorize.Net merchant account, businesses need to provide various documents to verify their identity and business legitimacy.

- Business License: A valid business license is usually required to demonstrate that the business is operating legally.

- Tax Identification Number (TIN): This number is used to identify the business for tax purposes. For businesses in the United States, the TIN is typically an Employer Identification Number (EIN) or Social Security Number (SSN).

- Personal Identification: Depending on the business structure, personal identification documents, such as a driver’s license or passport, may be required for the business owner(s) or authorized representatives.

- Bank Statements: Recent bank statements are often required to verify the bank account information and financial activity of the business.

- Website Information: If the business operates an online store, Authorize.Net may require information about the website, such as the URL and a description of the products or services offered.

Fees, Authorize net supported processors

Authorize.Net charges various fees associated with its merchant account services. These fees can vary depending on the chosen plan, transaction volume, and other factors.

- Monthly Fee: Some Authorize.Net plans have a monthly fee that covers basic services, such as account management and transaction processing.

- Transaction Fee: A percentage of each transaction processed is typically charged as a transaction fee. This fee can vary based on the payment method used, such as credit cards or debit cards.

- Authorization Fee: A small fee may be charged for each transaction authorization, which is the initial verification of the payment information.

- Chargeback Fee: If a customer disputes a charge and a chargeback occurs, Authorize.Net may charge a fee to cover the costs associated with resolving the dispute.

Customer Support and Resources

Authorize.Net provides a comprehensive suite of support options to assist merchants with their payment processing needs. From comprehensive documentation to interactive forums, they offer resources to address various levels of expertise and technical challenges.

Customer Support Options

Authorize.Net offers a variety of customer support options to cater to different needs and preferences.

- Phone Support: Merchants can reach out to Authorize.Net’s dedicated customer support team via phone for immediate assistance with urgent issues or complex inquiries.

- Email Support: For less urgent matters, merchants can submit inquiries through Authorize.Net’s email support channel. The team will respond within a reasonable timeframe, ensuring prompt resolution.

- Live Chat: For quick answers to common questions, merchants can utilize the live chat feature available on the Authorize.Net website. This allows for real-time interaction with a support representative.

Documentation and Tutorials

Authorize.Net provides a wealth of documentation and tutorials to guide merchants through various aspects of payment processing.

- API Documentation: Detailed documentation for the Authorize.Net API is available to developers seeking to integrate payment processing into their applications. It covers API endpoints, request parameters, response formats, and security considerations.

- Developer Guides: Comprehensive guides for developers are available, covering topics like setting up a merchant account, integrating payment processing into web applications, and implementing security best practices.

- Integration Guides: Specific integration guides are provided for popular eCommerce platforms, such as Shopify, Magento, and WooCommerce, facilitating seamless setup and configuration.

Community Forums

Authorize.Net maintains an active community forum where merchants can connect with peers, share experiences, and seek assistance from other users and Authorize.Net staff.

- Forum Categories: The forum is organized into categories covering various topics, such as API integration, security, billing, and troubleshooting. Merchants can search for relevant discussions or post their own inquiries.

- Knowledge Base: The forum also serves as a knowledge base, with archived discussions and solutions to common problems, providing valuable insights and resources for merchants.

Training Resources

Authorize.Net offers a variety of training resources to empower merchants with the knowledge and skills needed to effectively manage their payment processing.

- Online Training Modules: Self-paced online training modules are available, covering topics like account setup, transaction processing, fraud prevention, and security best practices.

- Webinars and Workshops: Authorize.Net hosts regular webinars and workshops, providing in-depth insights into specific payment processing topics, industry trends, and best practices.

Final Summary

In the ever-evolving landscape of online payments, Authorize.Net stands as a reliable partner for businesses seeking secure and efficient transaction processing. By understanding the diverse range of supported processors and their unique capabilities, merchants can choose the optimal solution to cater to their specific needs. Whether it’s expanding into new markets, optimizing checkout experiences, or ensuring compliance with industry standards, Authorize.Net empowers businesses to navigate the complexities of online payments with confidence.